Death and dying generates $3 trillion in annual revenue here in the U.S. But death is literally the least sexy industry on the planet, so there’s been an appalling lack of creativity and innovation in the space.

That $3 trillion number? It isn’t going down any time soon. We’re in the midst of a demographic shift of epic proportions. Revenues for these products and services will continue to rise. We’re fascinated and encouraged to see such massive opportunities ahead for the providers of these essential products and services.

It got us wondering: Who stands to gain the most from this growth?

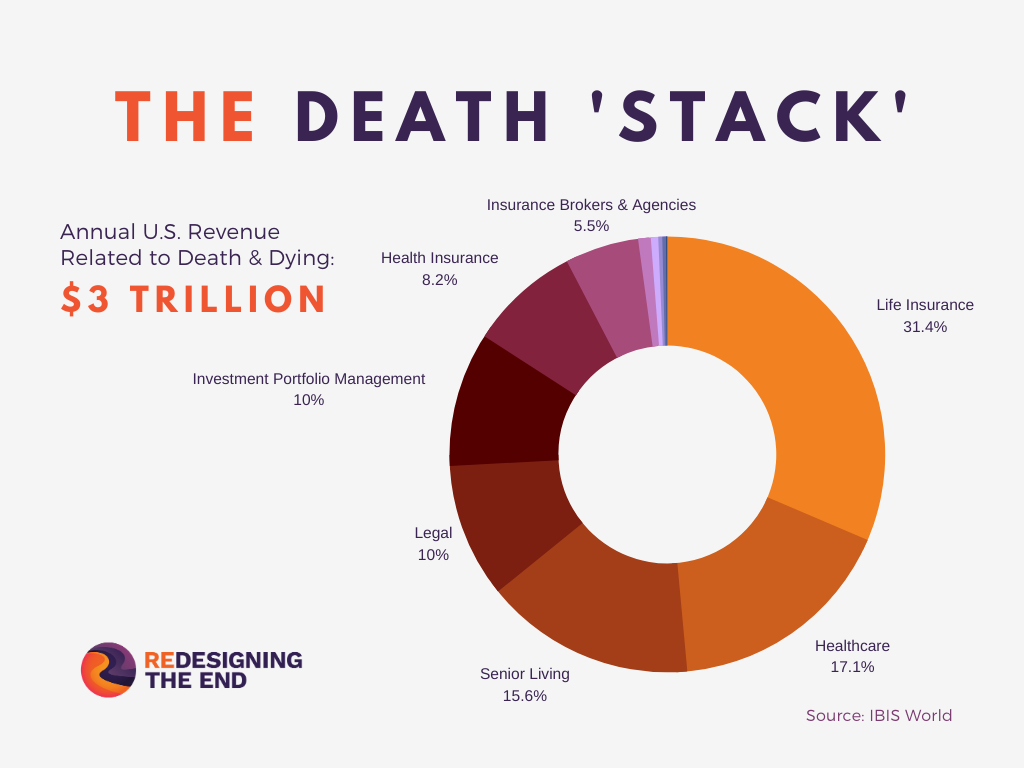

To answer that, let’s look at how the $3 trillion breaks down. Who are the players and what are they selling?

Here are the ten largest revenue generating industries within the “Death Stack”:

- Life Insurance generates $954B in annual revenue. This is broken down into premiums paid by individuals and organizations, plus the investment income earned by the insurance companies.

- Healthcare generates $520B in death-related revenue. No surprise there. But it’s interesting to see how much bigger this is than Hospice & Palliative Care, which is way down this list at #8.

- Senior Housing is a $475B industry in the U.S. Nearly everyone agrees this industry is hugely inefficient and inequitable.

- Legal fees related to death bring in $304B every year. This includes estate planning, wills & trusts, probate, family law, etc.

- Investment Portfolio Management represents $303B in annual revenue. These are just the fees paid to money managers. 60% of these fees are paid by institutional investors and 40% by individuals.

- Health Insurance during the last year of life generates $250B every year for providers. Approximately 25% of annual healthcare spend happens in the last year of life.

- Insurance Brokers and Agencies are paid $165B in fees and commissions every year. This doesn’t include direct payments made to life insurance providers or companies who self-insure.

- Hospice & Palliative Care generates $29B annually. 90% is paid by Medicare or Medicaid. Some providers are non-profit organizations and they compete with for-profit companies.

- Funeral Services ($16.7B) & Memorialization ($1.1B) represents a $17.8B market. Cremation is on the rise and virtual funerals have slowed growth for traditional funeral homes. While there has been consolidation among traditional providers, there are some real innovators challenging the traditional model here.

- Realtors ($9B) & Cleaning Services ($8.27B) generate $17.27B when you combine them. Though not always offered together, these are complimentary services provided to seniors and families navigating a transition into Senior Living (#2 above).

Where do you see opportunity in these numbers?

We see opportunity in all of these industries. And we hope the winners are the professionals bringing creative solutions. We’d see all of that money as a lever to improve the end-of-life experience, and expect the winners to be the professionals bringing creative solutions to the market. Our money’s on the good guys to win.

The numbers above are important because they are huge. These are not small industries, and when combined, they touch every part of the economy. The need is universal, and the status quo stinks.

That’s a really exciting combination for an entrepreneur! We hope to support many of you in doing this work.